Abstract

In introduction part, it has been described that the “foreign investment” plans in the country can actually increase the employment ratio; perhaps those variable objectives need to increase their productivity for developing the mobilizing procedures in the country.

In literature review part, “Impact of Foreign direct Investment on Local Labour Regimes in India” has been discussed with necessary graphs. “Foreign direct investment (FDI) is illustrated as the category of creating a “cross-border investment” in India through which an investor of a residential area can be able to establish a proper economy.

Methodology chapter of this study has included different approaches considered in this research. Thus this chapter is considered as one of the crucial elements to conduct the research in an efficient manner. Different aspects that are related to a research like “collection of data”, analyzing all these and to present it in an efficient way to different observers are linked to this part.

Results of this study have discussed different aspects related to identified themes.

Discussion chapter of this study has included four different themes based on the main topic of this study. These themes have been developed depending on several findings of secondary data. Detailed analysis of these themes has been done in this chapter which helped in completing the thematic analysis of this study.

In the recommendation part, has suggested that “foreign direct investments’' in local labor regimes in India have been increasing the exchange policies for investment, which affects the competitive market in the country.

In the conclusion part, has concluded that the “foreign investment” plans in the country can actually increase the employment ratio, perhaps those variable objectives need to increase their productivity for developing the mobilizing procedures in the country.

Table of Contents

1. Outline

2. Introduction

3. Literature review

Advantages of “Foreign Direct Investment” on “Local Labour Regimes” in India

“Foreign direct investment” in creating the development of economic growth in India

Impact of “foreign direct investment” on creating employment opportunities

Factors that influence Foreign Direct Investment on “Labour regimes” in India

Aspects of “Foreign Direct Investment” inflows and their impact on the Indian economy

4. Methodology

5. Results

6. Discussion

7. Recommendations

8. Limitations

9. Conclusion

Reference

Appendices

Appendix1: FDI inflow in India

Appendix 2: Impact on FDI on employment and economy

List of figures

Figure 1: “Foreign direct investment” inflows into India

Figure 2: “Foreign direct investment” into India

Figure 3: FDI impact on hiring opportunities in India

Figure 4: FDI impact on hiring opportunities

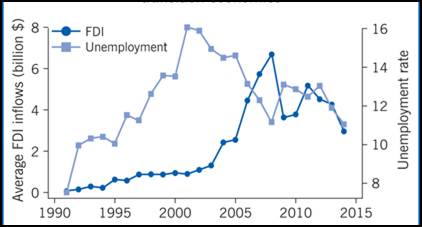

Figure 5: FDI and employment transition

Figure 6: FDI of India

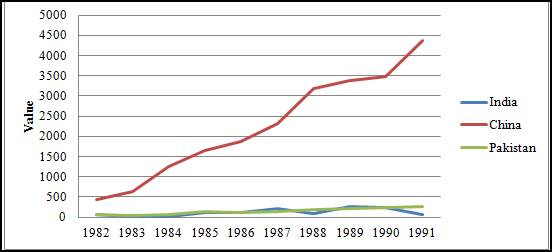

Figure 7: FDI in the employment sector in India

Figure 8: FDI inflows that shape the Indian Economy

Figure 9: FDI liberalisation in India

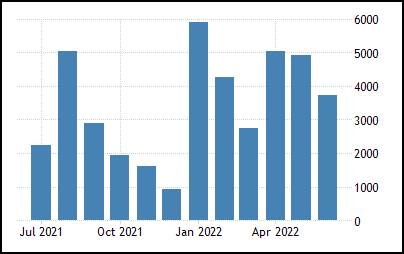

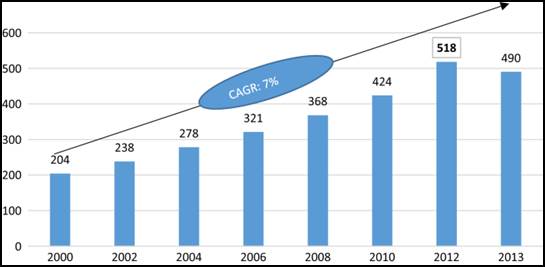

Figure 10: FDI Inflow

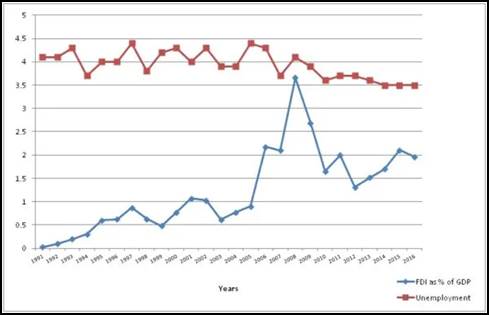

Figure 11: Unemployment decrease with respect to FDI

The direct investments from the international demand for developing contemporary strategies for increasing labor availability in India. This has critically impacted the new ventures in the business for maintaining their economical growth or sustainable long-term business in the market. This has emphasized the direct foreign plans and their implications in the market. These direct investment plans for the Indian market can increase their associated advantages for FDI. This growing linkage has increased the economic growth in the Indian market. FDI is the organization for increasing job growth and several investments that can emphasize their strategic balances in the economic developments of the country. This has been affecting the per capita income for those laborers and employees who invested their workforces for better consumption of the product in the market. This has been working on the market capabilities and developing the financial backgrounds of those labors in the market. This can create some effective man segment plans that can be proposed or increase their FDI involvement in the board. The per capita income of those variable organizations on the board can be critically analyzed for maintaining their economical sustainability in the market.

Impact of local laborers on the perspective of global investment planning in the market has been decreased. This has been affecting the FDI investment planning and its advantages in the global market. These investment strategies in the market can be increased by their marketing associations that can diversify the effective involvements and their foreign planning’s for the increasing marketing affiliations for India, in order to increase their per capita income. These effective workforces in the market can diversify the negative values and the disadvantages in the domestic plantings for increasing investment. This has made an important impact on domestic investments in the country. This effective strategy for marketing affiliations has increased labor productivity in India. This research paper has conducted a pepper analysis that can develop the indicators for those countries in order to generate more capital investments in their productivity growth plans in the market.

FDI has been critically observed and follows the variable capacity of the productive capacity of the market. That analysis has shown the surplus trends in the FDI exportations in the industry. These authorities have increased the tentative outlets that can be contributed to some granted technologies and methods for the country. This FDI contribution to the market has been affecting the market variability’s. Some of the foreign direct investments in local labor regimes in India have created some effective values for increasing the direct investment plans for the country. This has been affecting the per capita income for those laborers and employees who invested their workforces for better consumption of the product in the market. Employment growth rates in the country are quite low, and that can uplift the capital investments for increasing the sales per capita graph.

The prime aim of this research was to understand the potential of increasing investment plans or strategies that have been taken by FDI in order to increase employment growth in India. This decreasing ratio for unemployment has been very important for affecting the market ventures and their affiliations on the board. This can be in plain ended some fundamental goals for measuring the various difficulties in the investment process. This investment process needs to specify the actual aspects and their affability, where they can invest their capital. This descriptive investment strategy can improve the market affiliations and their usages for measuring the comprehensive disadvantages for the host country in order to gather a huge investment for decreasing unemployment in the country. This kind of foreign direct investment in local labor regimes can be helpful for developing the marketing variables and their social effects that can be helpful for improving the various investment plans in India.

“Foreign direct investment (FDI) is referred to as the category of creating a “cross-border investment” in a country through which an investor of a residential area can be able to establish a proper economy. This also tries to develop proper establishment with a lasting interest to a significant degree that can create an influence over an “enterprise resident” with other economies. In India, this FDI plays an important role in developing economy of this country by including different types of transfer technology in it . Apart from this, this FDI also permits the transfer of different technology that particularly helps to develop a new form of different varieties including several types of capital inputs. Hence, it cannot be achieved via several “financial investments” or dealing in goods as well as services. Moreover, this FDI can also boost its competition with the “domestic input market” which helps to create economic growth in India.

(Source: )

Here, this above-mentioned graph is showcased “Foreign direct investment” inflows into India from financial year (2012-2021). Hence, this is creating huge benefits for Indian economy by increasing amount of “FDI inflow” over all sectors of India. Despite creating an impact during the pandemic of corona virus or “(the COVID-19) pandemic”, this FDI is making total “foreign direct investment” which is related to inflow. Through this India can be able to reach a new height by increasing its economical status by “59 billion U.S. dollars” as of 2022. Hence, these “FDIs” are also considered important motorists of India's economy since it is trying to boost the job market and “technical knowledge base” and deliver “non-debt financial resources” in banking sectors . In this case, a growing country such as India can create a proper deal with “foreign investors” by finding “lower job wages” as well as “government tax exemptions” over FDI by providing a “lucrative offer” for business investments purpose within this country.

This is also growing in a favor of India, which is trying to develop “Foreign Direct Investment” over “Local Labour Regimes” in India. Moreover, this is also helpful for creating development in the financial areas of business industry. Those advantages are mentioned below,

- Advantages of Foreign Direct Investment creating economic development and stimulation.

- Try to create an easy type of international trade.

- Economic boost as well as employment

- Expansion of “Human Capital Resources”

- Advancement in “Tax Incentives”.

- Resource transferring system.

Apart from that, “Indian government” has been created and actively operating towards advancing its goal over business industry which is around “100 billion U.S. dollars”. It is also worth the “FDI inflows” that can be generated by 2020 through implementing various types of policy in business as well as including some “financial reforms” over its investment processes in business.

FDI helps to strengthen the "balance sheet" as it extends the assets of different companies. Hence, it is connected through profits which try to create an impact over businesses increase as well as Labour productivity that is required to increase. It is also related to "per capita income" which can increase as well as be related to consumption improvements. Here, this is also related to "Tax revenues" which can be increased with the help of government spending which rises. Apart from this, FDI is not directly related to economic conditions which can be able to make a proper try to ensure "economic growth" in India. Hence, this is also trying to develop proper interaction with "human capital" which exercises a strong type positive effect on economic growth in some developing countries including India. It can be developed while dealing with FDI as well as with other techniques that can remove the gap which has an influential negative impact. Moreover, this is also trying to ensure proper development of an organization through which "FDI" can able to stimulate its economic development through which employment opportunities can be increased. Hence, this FDI also tries to create results over the development of several types of "human resources" to ensure success in the business. This also tries to make enhancement of country's financial health as well as over different types of technology sectors. On the other hand, this is also useful to create an advantage over direct investment by implementing an automatic route.

(Source: )

Here, the above-mentioned graph is showcased India's financial year through FDI investment. From 2013 to 2018 it has increased at a huge rate that is necessary for creating business enhancement in India. It can be demonstrated that as of 2019 the highest amount of "foreign direct investments" (FDI) to India came from Singapore amounting to around "16.3 billion U.S. dollars". Apart from that, it can be stated that the "foreign direct investment" rate in India for 2019 was around "$50.61B" which is increased by a huge rate that is around "20.17%" increment in business from 2018. In India, the rate of "foreign direct investment" was around "$42.12B" which increased by "5.38%" from 2017 . On the other hand, its main objective is related to "FEMA" which was presented in India to facilitate some type of "external trade" as well as a payment method in the business industry. In addition, it is also related to the formulated assisting system in order to achieve orderly growth as well as maintenance of the "Indian forex market". Furthermore, this is highly needed to develop an FDI system over an "Indian multinational tool" that can able to enable its reach and grow its impact and trade activities in emerging consumption as well as in developed markets. This can also obtain its access to deal with different services that are quite eligible as well as unsolicited, technology and management over "Local Labour Regimes" in India.

On employment, FDI is creating a huge source of opportunities that can be able to enhance the source of employment in the business industry. It can be also demolished by FDI in India country, trying to create a proper lead in business that can deal with an expansion in output by growing its production activities. Hence, its increased amount of demand can be able to create a huge impact on its Labour. Hence, this is also related to different technologies that are limited to the capacity of Labour and reduce its need for unskilled workers. However, it continued to grow demand for capable Labour in business market.

In addition, it can be argued that “Foreign direct investment” is deemed as a “strategic policy” that is trying to reduce “unemployment rate” in this country. Hence, it is also related to market diversification, “Lower Labour costs”, Tax incentives, “Preferential tariffs”, and different Subsidies. Moreover, this is trying to create an inflow of several types of “FDI strategies” over a business that can be able to make enlarge “wage gap” between some foreign firms and “domestic firms”. Foreign firms also consist of a higher type of technological level as well as the managerial level to create an increment in relative demand that is required for skilled workers. This is also required to prevent the loss of several types of highly qualified workers, as well as over foreign firms which often pay a “higher wage”.

Stephen Farrall, Emily Gray, Alexander Nunn & Daniela Tepe-Belfrage (2022) Global pressures, household social reproduction strategies and compound inequality, New Political Economy, 27:4, 713-729, DOI: 10.1080/13563467.2021.2007231

(Source: )

Here, the above-mentioned figure tries to demonstrate the impact of FDI on rate of "hiring intent" across different states of India. In 2022, rate of employment intent across this country has been created by various types of organizations as well as corporations that stood around "35 percent". Moreover, it has increased a quite bit as compared to previous year when "hiring intent" was taking place at around "19 percent" . Furthermore, it is also focused on figures which showed a "positive growth” which also tries to create an indication of economic growth. In addition, this is also trying to create an "inward investment" which leads to creating higher "productivity growth" through creating an increased type of availability of resulting and capital in economic competition. Furthermore, productivity is considered a "key factor" that helps to increase "U.S. competitiveness" and extends living standards to ensure better productivity.

(Source: )

Through above-mentioned graph, it can be stated that "FDI" is creating a huge effect on employment as well as on different types of manufacturing sectors in India. Apart from this, it also trying to create a huge effect that can be referred to as an adverse effect related to several types of "unregulated FDI" including reduced amount of "domestic research" as well as growth, diminished match, "crowding-out" of different domestic firms as well as over lower employment. Hence, it can also able to create an enhancement over Labour productivity that can be increased through using different aspects for firm’s improvement. Moreover, this is also useful for creating an effect on "Tax revenues" of India which can increase over time.

The impact of "Foreign Direct Investment" on "Labour regimes" particularly focuses on wages and employment. It continues to focus on important issues related to "labour surplus" in the developing economies of India. In India, the continuous progress of "economic reforms" has been seen in the liberalisation of the "Foreign Direct Investment" policy. FDI is claiming a huge chunk of "aggregate investment" in an Indian economy . The process of Indian economic growth is based on FDI and their policies. This helps to meet the "sufficient growth test of employment". The process of "economic reforms" is continuously enlarging the "Foreign Direct Investment" roles.

(Source: )

Foreign firms possess a huge bundle of “intangible assets” such as organisational skills, product differentiation, superior technology and management. This provides “monopolistic advantages” and allows an organisation to focus on local and third-party country firms. “Local labour regimes” in India shows differential “labour market outcome” and emanate directly from “nature of technology” and foreign firms. In foreign firms, employees are relatively skill-based technologies and capital-intensive than in domestic firms . This lead to reduction in “employment elasticity of output” and shows comparison to domestic firms.

FDI focuses on highly skilled workers for increasing production and reducing “labour turnovers”. In addition, the roles of “Foreign Direct Investment” have a significant implication on the distribution of “national income” and tend to provide benefits to the minor sector of “Local labour regimes”. Foreign firms are “dominant producers” in the Indian market and enhance their roles with passing years . They have a significant impact on the “Local labour regimes” of India in terms of wages and employment. It has been examined that “Foreign Direct Investment” or foreign ownership has obtained “firm-level employment” and “wages data” of local labour in India. Employment data related to local regimes in India are available in “companies act 1956” and “particulars of employees rule, 1975”.

(Source: )

India's "Foreign Direct Investment" inflows and increased its record by approximately US$ 80,970 million, by 8 to 10% in a financial year. According to the reporter of "World investment, 2022", India has to hold the eighth position in the "world's FDI recipients". "Foreign Direct Investment” strengthen "balance sheet" of the Indian economy and raises assets of the company. Profits of an organisation are raised and increase productivity of labour. Thus, "per capita income" is increased and consumption is developed. It has been evaluated that FDI does not show an adverse effect on employment and wages of Indian industries. In India, FDI is focused on increasing employment and decreasing unemployment in the country. It is also increasing the manufacturing and service sector and boosting performance of workers. Thus, employment has resulted in increased income sources for India.

“Foreign Direct Investment” has enhanced financial growth, stability and development of the Indian economy. It shows a positive impact on GDP growth and increases employment levels in the country. FDI policies acted as “resistors” during the financial crisis in a year 2008. There were certain pull factors that have attracted FDI in the Indian market and rapidly explore consumer markets. This developed a stable banking system, easy access to different countries, and accessibility to cheaper inputs . “Foreign Direct Investment” acted as a “solid complement” to domestic stock and investments are lower than 30 to 32% due to low savings. In the year 2000 April and September, total inflows of FDI were approximately $ 700 to $725.07 billion. On the other hand, inflows of FDI were approximately $300 to $315 billion.

(Source: )

This shows an increase in the amount of 40 to 50% of total "Foreign Direct Investment” inflow. In an Indian economy, roles and policies of FDI are considered as "long-term growth" of the economy. "Multinational corporations" bring technology and transfer it to domestic companies. Apart from this, it shows a major impact on the expansion and organic growth that takes place in domestic companies. This is useful in increasing employment and provides several benefits. Through, "Foreign Direct Investment” companies are involved in day-to-day business operations. The company are capable of controlling its own as well as business entities. In the year 2019, the Indian market received its highest "FDI inflows" of approximately $60.67 to $ 64.43 billion. Further, in the year 2014-2015, the "FDI inflows" were approximately $40 to $45.30 billion.

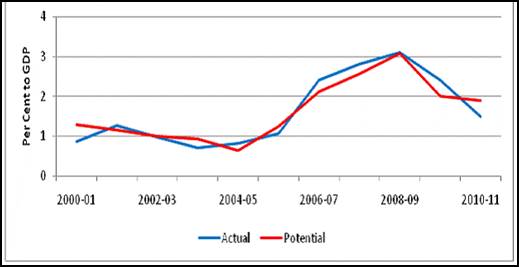

(Source: )

In the Indian market, the "Foreign Direct Investment" policies have been estimated to increase employment growth by 1% by a growth of "3 per cent". This employment rate has exported nearly 8 to 9 per cent, concluding FDI. Therefore, certain roles of FDI provide a certain outlet that increases surplus productivity and labour employment. It is considered a "strategic policy" that decreases the rate of unemployment in the "host country". "Foreign Direct Investment” is considered to be a contemplated and decisive catalyst that enhances employment rate in India . This open up "trade barriers" and promoted "trade liberalisation" in India. Therefore, an average "net inflow" of "Foreign Direct Investment" as a GDP rate of the Indian economy is nearly 2%. Policies of "Foreign Direct Investment" have taken an active part in the development and growth of different sectors. Hence, it shows the relationship between employment and the growth of the Indian economy. According to the "restrictive policies", an inflow of "Foreign Direct Investment" in the country is near about US$ 70 to 75 million. India has developed its FDI inflow by 2.2% and enhanced its telecommunication and information technology.

Haudi, H., Hadion Wijoyo, and Yoyok Cahyono. "Analysis of Most Influential Factors to Attract Foreign Direct Investment." Journal of Critical Reviews 7, no. 13 (2020).

Wol.iza.org, 2022. Foreign direct investment and employment in transition economies. Available from: https://wol.iza.org/articles/foreign-direct-investment-and-employment-in-transition-economies/long. Available on: 05.09.2022

Buckley, Peter J. "Towards a theoretically-based global foreign direct investment policy regime." Journal of International Business Policy 1, no. 3 (2018): 184-207.

Fernandez, Manuel, and R. Joseph. "Foreign direct investment in Indonesia: an analysis from investors perspective." International Journal of Economics and Financial Issues 10, no. 5 (2020): 102-112.

Tradingeconomics.com, 2022. Foreign Direct Investment in India increased by 3735 USD Million in June of 2022. Available from: https://tradingeconomics.com/india/foreign-direct-investment. Available on: 05.09.2022

Kalai, Maha, and Nahed Zghidi. "Foreign direct investment, trade, and economic growth in MENA countries: empirical analysis using ARDL bounds testing approach." Journal of the Knowledge Economy 10, no. 1 (2019): 397-421.

Projectguru.in, 2018. Impact of FDI on the employment sector of India. Available from: https://www.projectguru.in/impact-fdi-employment-india/. Available on: 05.09.2022

Projectguru.in, 2018. FDI inflow plays a vital role to shape the Indian economy. Available from: https://www.projectguru.in/fdi-inflow-necessary-indian-economy/. Available on: 05.09.2022

Asongu, Simplice, Uduak S. Akpan, and Salisu R. Isihak. "Determinants of foreign direct investment in fast-growing economies: evidence from the BRICS and MINT countries." Financial Innovation 4, no. 1 (2018): 1-17.

In research this part is considered as one of the crucial elements to conduct the research in an efficient manner. Different aspects that are related to a research like “collection of data”, analysing all these and to present it in an efficient way to different observers are linked to this part . It also deals with different approaches and philosophies which allow interacting with different people for different purposes. There are different ways which can be used to complete a research and collect relevant information. Following a proper research methodology allow to select an appropriate way to conduct a research and generate better results for the observers.

Different research philosophies are being used for conducting research in an efficient manner. “Positivism, interpretive, pragmatist and realistic” are some of the prominent research philosophies which are being used in a research to deal with different aspects of a research. In this research realism philosophy is being used to develop independent ideas and also to deal with real time problems and provide solutions based on the research topic. Different knowledge can also be implemented in research to achieve all the targets as per the schedule and helps to meet all the objectives of research.

“Inductive and deductive” are the types of research approaches that are taken into consideration to perform research in an effective manner. All these approaches help to collect data and analyse them both qualitative and quantitative data effectively. In this research inductive approach was followed thus the focus was given to the analytic process of the research. All the data are being collected by consulting different journals by identifying different problems and providing solutions regarding those problems. This inductive approach also established a loop between the intents of the research along with the results that were developed.

A proper plan helps a researcher to meet all the goals and acts as a pivotal point for the entire research. It also allow to make proper actions based on the research goals and also helps to use all the resources in an efficient manner so that proper results can be generated. All these things are confirmed by following a good research design and also all the work can be done with good flexibility. A proper plan also allows to maintain a good budget for the research and all the costs can be managed effectively . A proper plan also allows to identify different problems related to the research before hand and proper mitigation techniques can be implemented in the research.

All the risks can be identified before conducting a research by following a good research plan and by following a proper research plan all these challenges can be mitigated. Following good strategies for all the processes like data collection or analysing them, choosing suitable journals can be done effectively and less time is consumed to finish the research efficiently. Resources are very important to conduct research and following suitable plans and strategies allow establishing good resources and using them efficiently. All the plans and strategies must be made before hand so that no challenges arise during the conduction of research.

All these things were maintained to collect authentic data for the research and generate good results and to make a good impact on the audience. Data collection process is one of the main criteria which determine the future of the research. Different methods that are being implemented in research for this process are “primary qualitative and quantitative” and “secondary qualitative and quantitative”. Interviews, surveys, and data from different journals are being collected by following these techniques of data collection. In this research secondary qualitative methods were used for the collection process so that a good impact can be made on the observers. In this research there were predetermined journals and articles based on data of FDI and their impacts on the Indian economy and employment. In some research mixed methods are also being used which allow to collect huge quantities of data and conduct the research. In this research the chosen data collection procedure was secondary qualitative and different data was collected from the journals from trusted sources like “google scholar, pubmed, and proquest”.

After the collection of all the data a proper analysis is also needs to be done for the generation of better results from the findings and also to determine a good future scope of the research. Based on the data that was collected by following certain methods, different themes were developed to analyse the effect of Foreign Direct Investment on the economy of India and on the employees. The light was also shed on the increase in the number of employees after their involvement . A proper development of themes was done in this research and after analysing all these themes good results were also generated to help the observers based on different studies.

All the data that was required in this research were collected from different journals and articles from trusted sources thus different laws that are related to copyright issues were followed and acknowledgement has been done to all the authors of the paper that were used for the research purpose. Data that were related to FDI in India were also presented in a raw manner and no manipulation of all these data has been done for the sake of better results. All these ethics were followed in the research so that no challenges arise after the completion of the research.

In this part of research methodology different strategies, approach, and philosophies were used to conduct the research in an efficient manner. The secondary qualitative method was used in this research for the collection of different data based on Foreign Direct Investment and India for determination of good outcome from the research. Inductive approach was followed in this research as different journals were also considered to collect genuine data and conduct the research efficiently.

Theme 1: Role of Foreign Direct Investments in Indian Manufacturing is more toward the domestic output

Collaborating with the “Reserve Bank of India” different foreign institutions has invested in India for its growth. India has attracted different foreign investors due to some good future plans. The rate by which industrialization in India is growing investment of FDI has made a large impact on the economy of India. After the introduction of foreign cash in the Indian market there was a sudden growth in the infrastructure, and also in the manufacturing unit of the country. India is a major producer of different products like steel, vehicles, cements, sugar, and many others. The manufacturing unit has also grown with a good amount after the involvement of FDI in the market. Small organisations were facilitated by the huge amounts to implement different technologies in the core industry and increase their production. The increase in the production has helped these industries to generate good profit and this expansion has also helped many people to get jobs . The unemployment rate has also reduced after the introduction of foreign money in India.

Involvement of Forgein Direct Investment has boost the employment as different opportunities for job were established. The involvement of FDI has also helped many organisations to grow by significant rate and helped the country toi generate a good profit from export business. In recent years different products are being manufactured in India itself like different defence products, construction of high tech roads which has helped in boosting the economy. The Government of India is also establishing a good relation with different foreign institutions to expand their business in parts of the world and thai also has helped India to control the recession as compared to other countries. Many retail investors also came into existence after the involvement of FDI and companies with strong fundamentals have shown a huge jump in their stock price.

Theme 2: Labour impact of Foreign Direct Investments in India has resulted in generating employment

Increase in employability and wages of labourers are directly connected to the expansion of an organisation and the profit generation of that organisation after the involvement of FDIs. As per “new economic reform 1991” after the involvement of FDI different social evils were reduced as the rate of unemployment has reduced. All these involvement has helped different organisations to grow at certain rates and become a market leader in the industry. It can also be determined that the number of employees working in the organisation has also increased and the wages were also maintained. This shows that the impact of FDI on some of the big organisations of India was ambiguous. New strategies were also followed by FDI to increase the employment rates and also make people educated to become retail investors to earn money from different organisations. The rate dividends have also increased after the involvement of FDI as per different reports of India. Employees can also be transferred from one enterprise to another which will allow the people and also the employer to develop new skills and implement new ideas in the business.

Theme 3: Foreign Investment Policy Board (FIPB) has been facilitating foreign investments in India

“Foreign Investment Policy Board” has been funded to bring policies of FDI into the Indian market. FIPB performs as a bridge between non-government and government bodies, agencies, and firms to convey and decide FDI limits. It approves policies of FDI and controls flow of FDI in an Indian economy. According to “Foreign Investment Policy Board”, there are approximately 850 FDI proposals that have been disposed of . This process has been conducted through “Foreign Investment Facilitation Portal”. Policies of FDI have increased in several countries by bringing their policy to India. In the year 2015-2015, policies of FDI stood at USD 40 to 43.08 billion and increased to USD 59 to 60.20 billion in the year 2016-2017. Apart from this, the highest “annual FDI inflow” was USD 80 to 83.47 billion that has been reported in the year 2021 to 2022 during the global pandemic situation.

(Source: )

The Foreign Investment Promotion Board (FIPB) focuses on speed inflow of FDI and increases transparency in the approval policies of FDI. FIPB increase transparency and provide a clearance process in a proposal of FDI inflow. On the other hand, FIFF has developed “abolition” of “Foreign Investment Promotion Board”. FIPB take an active part in granting FDI policies and rules developed by “Foreign Exchange Management Act”. FDI liberalisation has provided sustainable development and diversification to the Indian economy. Thus, continuous growth encouraged more investment in different sectors by “liberalising” restrictive policies. The Indian economy has welcomed several MNC companies to invest and establish their business in India.

Theme 4: FDI in India can be seen to be either through M & A route or through Greenfield

In the Indian economy, it has witnessed highest value that deals with stock market. “Foreign Direct Investment” in India has regulated “Foreign investment policies” and brought the liberalised country. The government of India promote MNC companies to establish a business. The “central parliament” holds a “legislative power” that enacts several situations that is relevant to M&A . Key statutes are developed through “the companies act, 2013”, “the foreign exchange management act, 1999”, “the Indian contract act,1872”, and “the income tax act, 1961”. These statutes are typically associated with notifications, rules, and regulations related to FDI policies.

(Source: )

M&A is structuring typically and involves "share acquisition" either as a secondary purchase or a primary subscription. Demergers, mergers, and amalgamation are implemented by the "Special court", the "National Company Law Tribunal". Apart from this, the requirement of the "National Company Law Tribunal" shows an approval related to FDI policies . This requires approximately 24 to 26% of the shareholding and proposes 25% shareholding. In addition, a FDI inflow remained sluggish and focuses on widespread growth of economic sector in India. It focuses on gradual opening of "capital accounts" and emerges with a widespread investment of FDI flows in the Indian market. Further, it is considered an important "monetary source" that concentrates on development of "economic liberalisation". The FDI policies have decreased global crisis and steadily increased the Indian economy. FDI has globally ranked in first position in the FDI "Greenfield ranking" and ease performing business in the capital market of India . In the research study, it has been analysed that FDI decreases unemployment in a short-run and introduces "labour-saving technology". This increased growth of jobs in the "long-term" and explore productivity of labour.

Kastratović, Radovan. "Foreign direct investment impact on market concentration in the manufacturing sector of Bosnia and Herzegovina." Facta Universitatis, Series: Economics and Organization 1 (2018): 135-148.

Liu, Hongbo, and Hanho Kim. "Ecological footprint, foreign direct investment, and gross domestic production: Evidence of belt & road initiative countries." Sustainability 10, no. 10 (2018): 3527.

Nwosa, Philip Ifeakachukwu. "Foreign direct investment in Nigeria: Its role and importance in industrial sector growth." Acta Universitatis Danubius. OEconomica 14, no. 2 (2018).

Sokang, Khun. "The impact of foreign direct investment on the economic growth in Cambodia: Empirical evidence." International Journal of Innovation and Economic Development 4, no. 5 (2018): 31-38.

Fernandez, Manuel, and R. Joseph. "Foreign direct investment in Indonesia: an analysis from investors perspective." International Journal of Economics and Financial Issues 10, no. 5 (2020): 102-112.

Link.springer.com , 2018. Policy of foreign direct investment liberalisation in India: implications for retail sector. Available from: https://link.springer.com/article/10.1007/s12232-018-0306-y. Available on: 05.09.2022

Kalai, Maha, and Nahed Zghidi. "Foreign direct investment, trade, and economic growth in MENA countries: empirical analysis using ARDL bounds testing approach." Journal of the Knowledge Economy 10, no. 1 (2019): 397-421

Rbi.org.in, 2022. Foreign Direct Investment Flows to India. https://www.rbi.org.in/scripts/bs_viewcontent.aspx?Id=2513. Available on: 05.09.2022

Fernandez, Manuel, and R. Joseph. "Foreign direct investment in Indonesia: an analysis from investors perspective." International Journal of Economics and Financial Issues 10, no. 5 (2020): 102-112.

Buckley, Peter J. "Towards a theoretically-based global foreign direct investment policy regime." Journal of International Business Policy 1, no. 3 (2018): 184-207.

Discussion on Theme 1:

Most foreign organisations have entered relevant Indian markets by participating in different existing enterprises. FDI-led productions thus have been identified to be beneficial to the Indian economy as these productions have been observed to contribute to domestic output of existing organisations in India . These contributions have been estimated to increase the gross sales of different manufacturing organisations or individual industries. This increased gross sales in different industries have also been identified to provide foreign investment industries with a dominant position in respective manufacturing markets in India. FDIs in Indian markets have further been seen to cover a wide variety of industries. Due to its influence on Indian domestic manufacturing industries, FDI can also be seen to have an important role in increasing the overall GDP (Gross Domestic Product) of India. Based on this, it can also be said that stocks related to FDI can be helpful in representing overall economic contributions to the Indian manufacturing market.

Several studies have been done with the aim of concluding the influence of FDI in the Indian manufacturing market however, an appropriate conclusion has yet to be achieved. Based on these studies, it can be seen that firms that rely on FDIs, are being more beneficial to the overall growth of respective organisations. In this context, it can further be seen that around 26% of large private organisations with 33% of manufacturing organisations in India are relying on several FDIs. The Indian government has been identified to be reluctant towards FDI at first which resulted in a sharp decline in different manufacturing industries in India. However, the recent liberation of FDI policy in India has increased FDI inflows in India. This sudden increase in FDI inflows in India has thus been observed to contribute more towards domestic production. Based on this, it can be evaluated that FDI investments have been rising in each year and is becoming more focused on Indian manufacturing industries.

Discussion on Theme 2:

FDI investments in India have been identified to have a greater impact on the Indian economy as a whole and thus it can further be said that these investments are also having a significant impact on labour market of India. Several FDI investments have helped several organisations in India to have an opportunity to increase their respective capacity and production. With an increase in production and capacity, these organisations have been employing more and more individuals each year . Based on this, it can be evaluated that FDI investments in India have been providing more employment opportunities to individuals and have also been indirectly influencing wages provided to employees.

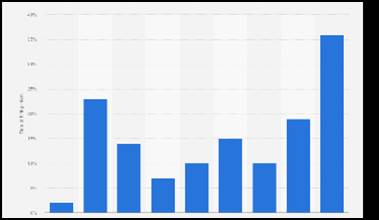

(Source: Mishra, Ronismita and Swapnamoyee, 2020)

Based on above representation, it can be seen that unemployment rate in India has decreased over time with respect to the increase in FDI inflows. This data can also be confirmed by addressing to “PROWESS database” of “CMIE (Centre for Monitoring Indian Economy)”. However, in terms of validation of data by following this database, it can only be gained after the year 2000 . This happens due to “Companies Act (1956)” and “Companies Rules (1975)” as both these provisions never asked organisations in India to reveal employee numbers. Amendments in these provisions in the year 2000 have made it possible to know number of employees in different organsiations. FDI inflow in India has helped organisations to increase in capacity to output more and thus create demand for labour however, it has also been observed that with an increase in different technologies demand for unskilled labour has been decreasing over time. Globalisation and end of several trade restrictions have helped FDI inflows in Indian market which offered a win-win scenario to all parties included. Different Indian sectors have been observed to have FDI inclusions however, these inclusions are asymmetrical which defines that different industrial sectors in India can have different effects of FDI on employment rate.

Discussion on Theme 3:

With FDI inflows in the Indian economy, the government of India has introduced a “structural adjustment program” alongside the “macro-economic stabilisation”. The Indian government has been identified to be working with IMF and World Bank on this aspect. Introduction of these aspects has been beneficial to the Indian government to implement a more “liberal foreign policy” that can define different rules and regulations related to foreign investors. These rules and regulations have further been identified to be loosening restrictions that have previously been placed on foreign investors and thus this step by the Indian government has offered an opportunity to have more FDI inflows. Along with the introduction of “liberal foreign policy”, the Indian government has developed a promotional board which has been identified to be responsible for maintaining different foreign investments and facilitating them. This board on a later date has been defined as “Foreign Investment Promotion Board (FIPB)” . Several sets of data have confirmed efficiency of FIPB and according to these data sets, India has been observed to have a baseline of US$ 1 billion as foreign investments in 1990 whereas, during 2010-2012, India has become the second most destination for foreign investments. A survey by UNCTAD has also pointed out that different sectors in India have been affected by this sudden surge in FDI inflows.

FIPB has also been seen to have different functions which included fundraising, communicating with different bodies, bridging the difference and implementing efficiency and transparency in industries. Covering these functions, FIPB can help in speeding up a process regarding approval of FDI funds. This board can also help in raising FDI funds by maintaining transparency between different transactions. The Indian government can also be seen to have an FDI quota which can help different organisations to raise funds and FIPB has been responsible for this whole process. FIPB has also been identified to implement different campaigns which further helped in advertising different domestic sectors to FDI and thus has been further helpful in mitigating the gap between foreign investors and organisations. FIPB has also included different regulations and paperwork which in terms of limited funds are easier to manage by different organisations and investors.

Foreign Direct Investment (FDI) has been identified to help any organisation to increase its infrastructural integrity and thus FIPB can help organisations in this aspect. FIPB can also be identified to be beneficial to different domestic organisations in India as it can provide appropriate information on different aspects of FDI alongside more in-depth knowledge of foreign markets. FIPB can also be seen to provide newer organisations in India with access to different foreign markets which further helps them in optimising operational costs. Apart from these aspects, FIPB can also create some problems as it has been seen that incoming funds via FDI in India restrict an organisation to take opportunity of local investments. FDI inflows in India by FIPB also influence exchange rate of local currency in international markets. FIPB has also been identified to bring in more FDI investments which forced local organisations to be operational in the Indian market only as these organisations cannot compete in the global market due to inadequate competency.

Discussion on Theme 4:

FDI in the Indian market can also be seen to come through either M & A route or greenfield, however, when number of investments through these are compared it can be seen that greenfield investments are amounting to be higher than M & A investments. Depending on this difference in number of investments, it can be said that FDI investors have been preferring to invest more in newer organisations rather than acquiring or merging with an older one. Greenfield investments in this aspect can also be identified to provide funding to a new organisation or fund the expansion of an older one. Value regarding different greenfield projects cannot be found in “World Investment Report” by “UNCTAD” as investments in these projects can be materialised in different ways . Based on gathered data, it has been observed that FDI projects for greenfields in India have been highest in 2006 with its value being around 1027. Similarly, M & A FDI deals in India have been the highest in 2007 with their value being around 168.

Characteristics |

M & A |

Greenfield |

Transfer of skills |

- Less likely to transfer skills or technologies

- Restructuring can bring in new skills and technologies

|

Likely to transfer or implement better skills or technologies |

Employment |

- Employment generation can be seen way after entry

- This process can conserve employment generation if a respective organisation is closing

- Sequential investments and strengthened linkages can be more influential in employment generation

|

Employee generation can be seen as soon as it enters |

Capital |

- In long-term, sequential investments can be observed

- Initial capital is provided as a form of domestic assets to foreign investors

|

It can increase overall capacity of an organisation in a host country, thus can be said to be more beneficial in domestic manufacturing |

Existing assets |

It can include closure, relocation of different facilities that have been domestically present |

Never directly reduces or impacts domestic economy |

Market structure |

Can help to have an increased concentration in domestic markets |

Can help to have an increase in number of organisations in domestic markets |

Table: Comparison between M & A and Greenfield

(Source: Self-Developed)

From above representation, it can be seen that greenfield FDI investments in India have been more beneficial when compared to M & A FDI investments in different markets.

It has been recommended in this research, that the “foreign direct investments’' in local labor regimes in India need to be increased in order to develop the country’s GDP ratio. This research has recommended that the certain advantages of the “foreign direct investments’' in local labor regimes in India, has been increased their market variability’s that can affect the increased productive eagles on the board, for fixing those problems the government has been initiating the alignment projects with the foreign countries and their respective foreign investors . This research has recommended that the stimulated developments in the economic statement of a country need to be critically analyzed for understanding the variable problems in the research.

This research has suggested that verbal wages and their affiliations can be helpful for developing the foreign investment plan in the market. This research has suggested that “foreign direct investments’' in local labor regimes in India have been critically increasing the FDI policies and their proper implications in the market. This research has been critically encouraging all the important measurements and proper implications that can be helpful for the host countries' financial performances in the last decade. This financial performance by the countries has increased their FDI benefits that can develop superior marketing ventures and their implication in the investment policies. This research has recommended some developments in the financial structures of the country that can be helpful for delivering more comprehensive results on the board. This research has recommended that “foreign direct investments’' in local labor regimes in India can deliver more employment opportunities and their imp-locations in the market.

Sharma, Shruti. "Does plant size matter? Differential effects of foreign direct investment on wages and employment in Indian manufacturing." Asian Development Review 35, no. 1 (2018): 52-80.

Rao, K. S., and Biswajit Dhar. "India's Recent Inward Foreign Direct Investment: An Assessment." India's Recent Inward Foreign Direct Investment: An Assessment (2018) (2018).

Mishra, Ronismita, and Swapnamoyee Palit. "Role of FDI on employment scenario in India." International Journal of Recent Technological Engineering 8, no. 6 (2020): 1481-1489.

Doytch, Nadia, Nishant Yonzan, Ketan Reddy, and Filip De Beule. "Tracking greenfield FDI during the COVID-19 pandemic: Analysis by sectors." Foreign Trade Review 56, no. 4 (2021): 454-475.

Doytch, Nadia, Nishant Yonzan, Ketan Reddy, and Filip De Beule. "Tracking greenfield FDI during the COVID-19 pandemic: Analysis by sectors." Foreign Trade Review 56, no. 4 (2021): 454-475.

Emako, Ezo, Seid Nuru, and Mesfin Menza. "Determinants of foreign direct investments inflows into developing countries." Transnational Corporations Review (2022): 1-14. Extracted from: https://www.tandfonline.com/doi/pdf/10.1080/19186444.2022.2085497 accesed on: 05\09\2022

This research has recommended that the actual FDI investments can be diversified and developed for transferring the human capital in order to make more sustainability in their cash flow. This research has suggested that somebody roar scale investment ventures and their implication has generated some ripple effects on the economic stability of a country, that can be fixed by following the FDI policies and their implications in the market. This research has been advised that “foreign direct investments’' in local labor regimes in India can increase their capita per investment and their affiliations in the market. These increasing issues can improve their second layer advantages in the market that need to be improvised and implicated more essential leverages in the industrial relations with the government officials.

His research has suggested that “foreign direct investments’' in local labor regimes in India have been increasing the exchange policies for investment, which affects the competitive market in the country . It has been also advised that some financial disadvantages have affected their foreign investors in the country's most backward area. This can be stated that India has been prominent for measures of their capital investments; perhaps this country would not have prospected to attempt their trillion dollars economy's promise. This has been suggested that few instances in the process of investment can decrease the fundamental stability ratio. This can be helpful for their essential mainstream of generating cash revenues in the market.

This research paper has elaborated on a possible transformation process in order to maintain their international relationships with the FDI investors in the country. This research paper has elaborated the policies on the “foreign direct investments’' in local labor recruitments in India, which can be important for understanding the fundamental rights of those laborers and their financial affiliations this research paper has elaborated that second-order advantages for their customers can affect the employees motive or decreasing the influential ratio in the market. This research paper has elaborated on the comparison of FDI investments that can increase the interest rates of the market. This geopolitical investment in the country by the foreign investors has been taken much positively by the citizens as their wish in order to join as a labor in order to contribute to the work and increase their financial stability in the market.

This research has elaborated some effective measurements and their comparable feasibility that can improve the outweighs elements in the country's domestic overtakes in the market. This research paper has elaborated that political influences in the market can be helpful for increasing their direct investment plans for the market . This research paper has elaborated on some effective FDI ventures that can be helpful for increasing the direct investment plan and their implications on the board. This research paper has elaborated on some different paths in the research, and those different routes in the research. These research variabilities can be diversified into some measured infrastructures that can develop automatic routes and governmental routes in this research perspective.

This research paper has been critically discussing the converted services and their implications in the market. This research purpose has been affecting the mentioned market variability that can be improved their market affiliations on the board. This research has elaborated that selective marketing ventures in this model of foreign investments have created some dominant productivity affiliations. Those valuable effective marketing ventures can be helpful for multi-rand content services in the market. This can be helpful for measuring the go fundamental affiliations on the board. This effective productivity has created negative impacts on the market and can be helpful for analyzing the market variability.

This research has concluded that the “foreign investment” plans in the country can actually increase the employment ratio, perhaps those variable objectives need to increase their productivity for developing the mobilizing procedures in the country. This research has declared that This foreign direct investment in local labor regimes in India by the FDI has had a prominent effect on certain developments in the unemployed ratio of India. This research gathered some informative sources that enhance the marketing variables and their associations for this particular research. Therefore it has increased the understanding of this topic that can improve their FDI investments in India. It has been also declared that some FDI growth in the critical developments in India can be measured as a financial amendment plan or strategy that can create an important role in maintaining the product's effectiveness and potential affiliations in the business in the country.

This has been declared that their FDI policies have been critically increasing the productive capacity of the market, which can increase their social investment plans and their industrial advantages on the board. This research has stated that the infrastructural advantages in the market can actually increase the market variability’s, for increasing their recent capital investments in the market. These financial investments in the market can be critically mentioned in the role of investment plans in the market. This has had an effective impact on the FDI planning for increasing born capital availability in the market. This has been decreasing the unemployment ratio for the country in order to generate some effective cash flows and disabilities in the growing market. It has been declared that some investment plans have positive potential towards the recent industrial investment policies, perhaps they need to generate direct plans for the vertical advantages in the Indian market.

Babu, Abraham. "Causality between foreign direct investments and exports in India." Theoretical & Applied Economics 25, no. 4 (2018). Extracted from: : http://store.ectap.ro/articole/1363.pdf accesed on: 05\09\2022

This research has declared that selective marketing ventures in this model of foreign investments have created some dominant productivity affiliations. This effective productivity has created negative impacts on the market and can help analyze the market variability’s. This research has gathered some effective information on “foreign direct investments’' in local labor regimes in India that can be helpful for the automatic human resources in the market. Therefore the market variability and thorn assassinations can be described by some impactful numbers of increasing market investment plans by the FDI. These kinds of automatic routes and their applications on the fundamental changes in the investment strategies have created some negative impact on understanding the impact of recent investments in the market. This increasing marketing venture and their affiliations for the market analysis has increased the efficiency of those investment policies. Those variable market policies in the market have been affecting the fundamental growth and their impacts on the FDI policies in India. This research has concluded that the growth of GDP in the host country can develop their foreign policies that can be helpful for the market variability’s and their effective information in order to increase the fundamental developments in the country.

Journal

Asongu, Simplice, Uduak S. Akpan, and Salisu R. Isihak. "Determinants of foreign direct investment in fast-growing economies: evidence from the BRICS and MINT countries." Financial Innovation 4, no. 1 (2018): 1-17.

Babu, Abraham. "Causality between foreign direct investments and exports in India." Theoretical & Applied Economics 25, no. 4 (2018). Extracted from: : http://store.ectap.ro/articole/1363.pdf accesed on: 05\09\2022

Buckley, Peter J. "Towards a theoretically-based global foreign direct investment policy regime." Journal of International Business Policy 1, no. 3 (2018): 184-207.

Doytch, Nadia, Nishant Yonzan, Ketan Reddy, and Filip De Beule. "Tracking greenfield FDI during the COVID-19 pandemic: Analysis by sectors." Foreign Trade Review 56, no. 4 (2021): 454-475.

Emako, Ezo, Seid Nuru, and Mesfin Menza. "Determinants of foreign direct investments inflows into developing countries." Transnational Corporations Review (2022): 1-14. Extracted from: https://www.tandfonline.com/doi/pdf/10.1080/19186444.2022.2085497 accesed on: 05\09\2022

Fernandez, Manuel, and R. Joseph. "Foreign direct investment in Indonesia: an analysis from investors perspective." International Journal of Economics and Financial Issues 10, no. 5 (2020): 102-112.

Gupta, Rhea. "Impact of FDI on employment: evidence from India." PhD diss., Master thesis, Yale University, New Haven, Connecticut, 2020.

Haudi, H., Hadion Wijoyo, and Yoyok Cahyono. "Analysis of Most Influential Factors to Attract Foreign Direct Investment." Journal of Critical Reviews 7, no. 13 (2020).

Jean-Baptiste Velut, Gabriel Siles-Brügge, Louise Dalingwater. (2022) Rethinking the Dynamics of Inclusion and Exclusion in Trade Politics. New Political Economy 27:4, pages 547-552.

Kalai, Maha, and Nahed Zghidi. "Foreign direct investment, trade, and economic growth in MENA countries: empirical analysis using ARDL bounds testing approach." Journal of the Knowledge Economy 10, no. 1 (2019): 397-421.

Kastratović, Radovan. "Foreign direct investment impact on market concentration in the manufacturing sector of Bosnia and Herzegovina." Facta Universitatis, Series: Economics and Organization 1 (2018): 135-148.

Liu, Hongbo, and Hanho Kim. "Ecological footprint, foreign direct investment, and gross domestic production: Evidence of belt & road initiative countries." Sustainability 10, no. 10 (2018): 3527.

Mishra, Ronismita, and Swapnamoyee Palit. "Role of FDI on employment scenario in India." International Journal of Recent Technological Engineering 8, no. 6 (2020): 1481-1489.

Nwosa, Philip Ifeakachukwu. "Foreign direct investment in Nigeria: Its role and importance in industrial sector growth." Acta Universitatis Danubius. OEconomica 14, no. 2 (2018).

Rao, K. S., and Biswajit Dhar. "India's Recent Inward Foreign Direct Investment: An Assessment." India's Recent Inward Foreign Direct Investment: An Assessment (2018) (2018).

Sharma, Shruti. "Does plant size matter? Differential effects of foreign direct investment on wages and employment in Indian manufacturing." Asian Development Review 35, no. 1 (2018): 52-80.

Sokang, Khun. "The impact of foreign direct investment on the economic growth in Cambodia: Empirical evidence." International Journal of Innovation and Economic Development 4, no. 5 (2018): 31-38.

Stephen Farrall, Emily Gray, Alexander Nunn & Daniela Tepe-Belfrage (2022) Global pressures, household social reproduction strategies and compound inequality, New Political Economy, 27:4, 713-729.

Veni, L. Krishna. "Inflow and Outflow of Foreign Direct Investments in BRICS Countries-An Analysis." Economy 7, no. 2 (2020): 98-103. Extracted from: https://www.researchgate.net/profile/Krishnaveni-Lankapotu/publication/343602100_Inflow_and_Outflow_of_Foreign_Direct_Investments_in_BRICS_Countries_-An_Analysis/links/5f33c8e292851cd302ef5d0b/Inflow-and-Outflow-of-Foreign-Direct-Investments-in-BRICS-Countries-An-Analysis.pdf accesed on: 05\09\2022

Website

Link.springer.com , 2018. Policy of foreign direct investment liberalisation in India: implications for retail sector. Available from: https://link.springer.com/article/10.1007/s12232-018-0306-y. Available on: 05.09.2022

Projectguru.in, 2018. FDI inflow plays a vital role to shape the Indian economy. Available from: https://www.projectguru.in/fdi-inflow-necessary-indian-economy/. Available on: 05.09.2022

Projectguru.in, 2018. Impact of FDI on the employment sector of India. Available from: https://www.projectguru.in/impact-fdi-employment-india/. Available on: 05.09.2022

Rbi.org.in, 2022. Foreign Direct Investment Flows to India. https://www.rbi.org.in/scripts/bs_viewcontent.aspx?Id=2513. Available on: 05.09.2022

Statista.com, 2019. Leading countries for foreign direct investment into India from financial year 2013 to 2019.Accessed from:.https://www.statista.com/statistics/1200213/india-major-investing-countries/. Accessed on: 05.09.2022.

Statista.com, 2022. Rate of hiring intent across India from 2014 to 2022. .Accessed from: https://www.statista.com/statistics/1043144/india-hiring-intent-change/. Accessed on: 05.09.2022.

Statista.com, 2022. Total amount of foreign direct investment inflows into India from financial year 2012 to 2021, with an estimate for 2022.Accessed from: https://www.statista.com/statistics/715539/india-fdi-inflow-amount-for-all-sectors/. Accessed on: 05.09.2022.

Tradingeconomics.com, 2022. Foreign Direct Investment in India increased by 3735 USD Million in June of 2022. Available from: https://tradingeconomics.com/india/foreign-direct-investment. Available on: 05.09.2022

Wol.iza.org, 2022. Foreign direct investment and employment in transition economies. Available from: https://wol.iza.org/articles/foreign-direct-investment-and-employment-in-transition-economies/long. Available on: 05.09.2022

(Source: https://www.ibef.org/economy/foreign-direct-investment)

(Source: http://employmentnews.gov.in/newemp/MoreContentNew.aspx?n=Editorial&k=67)

|